Right now we turn to a trusted tax fighter for a status report and behind the scenes struggle to earn fair taxation from local government.

Here's what stands out from this report from our perspective . . .

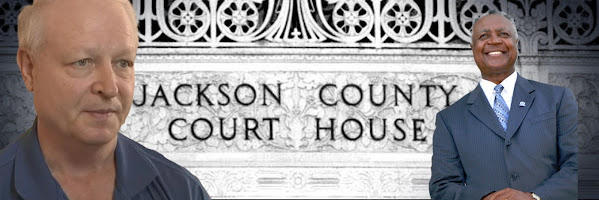

JACKSON COUNTY PROPERTY TAX ASSESSMENT APPEALS REACH RECORD NUMBERS!!!

Clearly there's something wrong with the process and it's encouraging that locals are speaking out.

Now, here's the word . . .

Preston Smith: Update on County Assessment Latest Moves

I am getting calls and emails from people today who are having their informal reviews with the Assessment Dept/Tyler Technologies people. In one case, the taxpayer had only comps from 2023 (which under state law should not be accepted) and only a couple of examples of repairs needed (without actual price quotes from contractors). Within minutes, the Tyler Technologies person agreed to lower his assessment to no more than a 14.9 percent increase.

As you will recall, in 2019, one out of three residential properties were increased by the magic number of 14.9 percent when the County could not prove that a physical inspection actually occurred. Under the state law, it is illegal for them to increase an assessment higher than 15 percent without that proof. Taxpayers who have been receiving their Sunshine Act requests from the County have been forwarding them to me to show how thin the information is that the County used to base the assessment value on for their property. It is pathetic.

The only evidence of a "physical inspection" have been photos from the street of the house, which under the County regulations and the state law, do not qualify as a physical inspection. If you have not made a Sunshine request of the County Assessment Department to make the show their "homework" for how they arrived at the value of your property, please do so. I believe the more of us that keep the pressure on them--and call them out for deliberately breaking the state law--the sooner you will get your values lowered.

The Assessor told the County Legislature on Monday that there were 33,000 appeals filed. The number of appeals are increasing by about 1,000 a day. At this rate, by the time the July 31 deadline occurs, there will be 50,000 to 60,000 appeals filed, which would be a statewide record. I URGE you all to make an appeal. I believe the County Assessment and Board of Equalization is reaching the breaking point, and they are going to, if they are not already, rubber-stamping 14.9% increase as fast as they can.

This makes the case even stronger that the BOE should step in an initiate a county-wide flat rate increase, since that is essentially what it appears that the County is doing right now, for those who appeal. I ask you to continue to post here about your experiences, and from here on, you might want to figure out what a 14.9% increase would be in your assessment, and that is the value that you ask the County to give you.

#################

Developing . . .

Comments

Post a Comment

TKC COMMENT POLICY:

Be percipient, be nice. Don't be a spammer. BE WELL!!!

- The Management